Our team of underwriting experts will listen, evaluate and then help you develop a profitable portfolio. Our goal is to enhance your performance by building an underwriting platform that is effective and functional. By combining a sound underwriting foundation with superior claims handling, we provide long-term stability for the niche specialty market.

We offer a wide-range of commercial programs written on admitted, non-admitted, or a reinsurance basis. Options to meet the most demanding program needs are just a click away. Please contact us for more information.

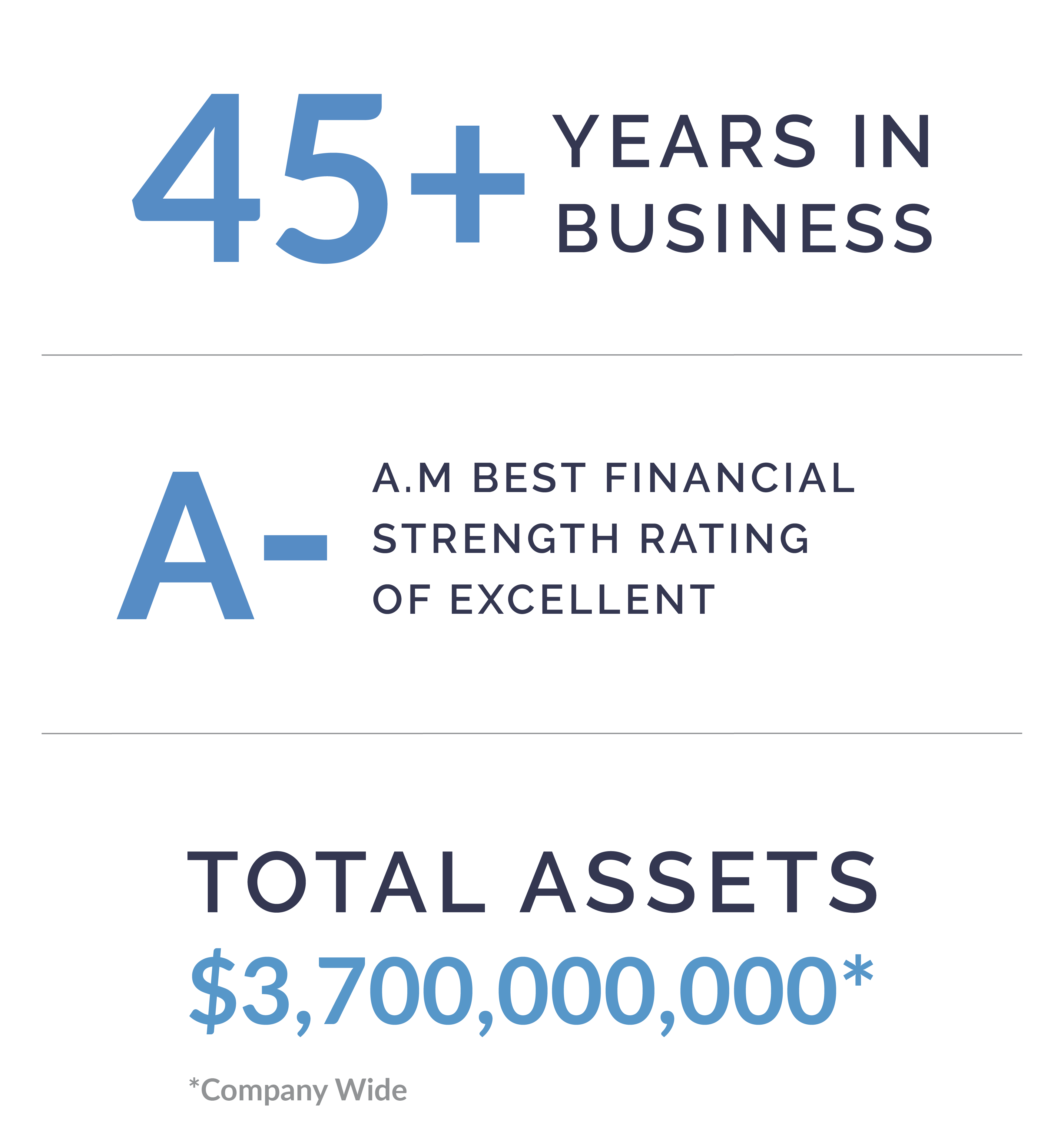

For over 45 years, we’ve been delivering reliable risk management solutions. Fortegra is more than an insurance and service contract provider, we’re a PARTNER committed to your success.

An industry leader for 45+ years, with an A- excellent financial strength rating from A.M. Best.

As a vertically-integrated insurer, we’re able to support all elements of the business.

Our experienced actuarial team ensures competitive, and sustainable pricing.

A collaborative approach that promotes successful, long-term relationships.

In order to better assist you, please choose from one of the following:

Specialty Insurance • Service Contracts

• Premium Finance

File a Claim • Download Documents

• Check Status of Claim • Contact Us

A Tiptree Company (NASDAQ: TIPT)

Connect with Fortegra