Embarking on its journey in the late 1970s as Life of the South, Fortegra originated as a regional monoline insurer with a vision that transcended everyday insurance solutions. The growth story accelerated in 2003, under the strategic leadership of current President and CEO, Richard Kahlbaugh joined the organization.

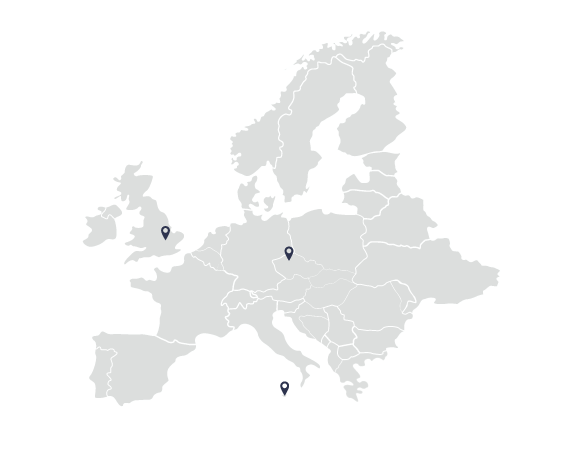

In this new chapter, Life of the South transitioned to the name Fortegra, a combination of the words Fortitude and Integrity. We ventured beyond traditional boundaries, diversifying into realms of specialty insurance, motor club services, vehicle service contracts, warranty solutions, and premium financing. This evolution was more than just broadening our services; it was about extending our reach. In 2019, our footprint spread across the Atlantic, establishing a presence in the United Kingdom and Europe.

In an ever-evolving digital age, Fortegra’s technology advantage paired with deep industry expertise has led to rapid growth in the global specialty insurance market. Upholding our enduring commitment to a partner-centric distribution model, we welcomed Fortegra Specialty Insurance Company to our portfolio—an excess and surplus lines carrier designed to enhance our partners' capabilities.

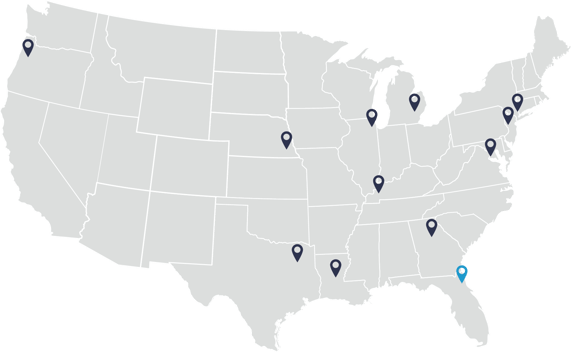

Much has changed since our humble beginnings, but what hasn’t changed is our commitment to excellence. We are a multiline, global specialty insurer, headquartered in Jacksonville, Florida and have 15 locations globally. Fortegra takes pride in an A.M. Best Financial Strength Rating of A- (Excellent), Category VIII, underscoring our reliability and financial stability. As a member of the Tiptree family of companies, we are listed on NASDAQ (TIPT).

Join us in our ongoing narrative of consistent profitability, focused innovation, and a superior partner experience. With Fortegra, you're not just a spectator but a part of a story where we collectively empower our partners, people, and policyholders, nurturing an ecosystem of mutual growth and success. Experience the Fortegra difference—where your confidence is our commitment.

Life of the South founded as a Regional Monoline Insurer.

Strategic acquisitions coupled with organic growth. Expanded product and service offerings.

Changed name to Fortegra Financial. Through acquisitions, expanded into Motor Club and Premium Finance businesses.

Fortegra IPO with rigorous public audit and Sarbanes-Oxley compliance.

Through acquisitions, begin offering service contracts and protection plans for consumer products such as mobile devices, furniture, electronics, appliances and more.

Multiline Specialty Insurer with expansion into specialty markets.

Expanded globally with Fortegra Europe Insurance Company Limited (FEIC Ltd.)

Exceeded $1.6 billion in premiums & premium equivalents. Launched E&S company Fortegra Specialty Insurance Company.

Warburg Pincus strategic investment in The Fortegra Group, LLC accelerates growth as a Global Specialty Insurer.

Fortegra began in the late 1970’s, as Life of the South, a credit insurer in rural Georgia. Under the leadership of founder Butch Houston, then Ned Hamil, and now current President and CEO Richard Kahlbaugh, Life of the South grew to become the second-largest credit insurer in the United States.

In 2008 Life of the South transitioned to the name Fortegra, a combination of the words Fortitude and Integrity, and continued its rapid growth expanding into specialty insurance, motor club, vehicle service contracts, warranty solutions and premium financing. Fortegra not only broadened their product offering, they expanded geographically with the introduction of Fortegra Europe Insurance Company Limited (FEIC Ltd.).

Fortegra’s technology advantage and industry expertise have led to rapid growth in the global specialty insurance market. As part of an ongoing commitment to an agent-driven distribution model Fortegra Specialty Insurance Company, an excess and surplus lines carrier, was recently added to the portfolio.

Much has changed since our humble beginnings in rural Georgia, we are now headquartered in Jacksonville, Florida and have more than 12 locations globally. What hasn’t changed is our commitment to excellence. Fortegra boasts an A.M. Best Financial Strength Rating of A- (Excellent) Category VIII and trades on NASDAQ as part of Tiptree family of companies (TIPT).

In order to better assist you, please choose from one of the following:

Specialty Insurance • Service Contracts

• Premium Finance

File a Claim • Download Documents

• Check Status of Claim • Contact Us

A Tiptree Company (NASDAQ: TIPT)

Connect with Fortegra